Grid trading on the Binance spot market is an alternative to third-party trading bots developed by the exchange itself. The user needs to set the initial parameters, after which the orders will be created automatically in accordance with them. It cannot be said that Grid Trading does not require any knowledge and skills at all from the user – for the result to be as effective as possible, one will have to delve into many parameters. Profinvestment.com editors will tell you about the features and nuances of this relatively new tool.

What is grid trading

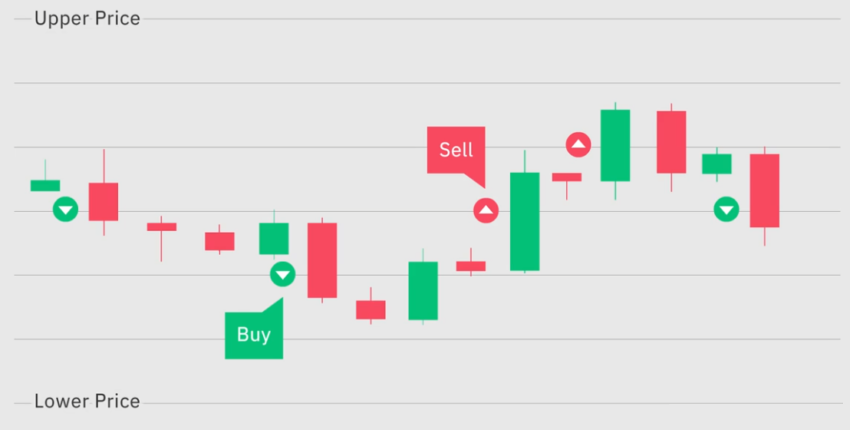

Grid trading is the method of trading, when buy and sell orders are created at specified intervals around a given price. Visually, this methodology resembles a grid, hence the name. Grid Trading is ideal in volatile and competitive markets, such as the cryptocurrency market. In this case, every time the sell price exceeds the buy price during a sideways movement, low Buy orders are automatically executed, which then lead to high Sell orders.

There is no need for careful market forecasting. But in order to increase profit it is important to take into account a lot of factors. As a rule, a good choice for this type of trading is a pair whose rate is characterized by frequent and significant ups and downs.

Why automated grid trading is so in demand:

- It’s convenient. You can figure it out quickly, and there are no overly complex calculations that require a lot of experience.

- This is effective in terms of risk management. The strategy allows you to adjust the risk/profit ratio much more competently than others.

- It’s reliable. The trading approach has been proven over the years, and many traders have been practicing it for decades in a wide variety of markets.

- It is a flexible tactic. It easily adapts to different market conditions.

Finally, grid trading is ideal for automation – it is extremely logical, has a clear structure of actions and does not depend on the behavior of the market.

Grid Trading on Binance

The trader can adjust the grid parameters, its frequency, set the upper and lower limits. Then the system automatically places orders based on the set criteria, above and below a specific price.

Mechanism of operation

Using Grid Trading involves the following steps:

- Setting the starting structure of the grid. It means definition of price levels from the last fixed market price, setting limit orders with the rate above and below the market price.

- Strategy activation.

- Opening of positions. The initial position is activated when the market goes beyond the price level after the start.

- Grid Update. The structure is updated whenever one of the set price levels is reached. In other words, after the limit order is executed.

- Stop triggers for risk control. They help to achieve immediate execution of limit orders or their triggering at the moment of reaching a certain rate.

- Stop. It is done either manually or by a preset stop trigger.

Once the grid is stopped, you can cancel all orders manually or set them to cancel automatically.

Basic parameters

Setting up a grid trading strategy on Binance includes the following parameters:

- The pair on which the bot will trade.

- The top and bottom boundaries of the rate level. Above or below these designated levels orders will not be opened.

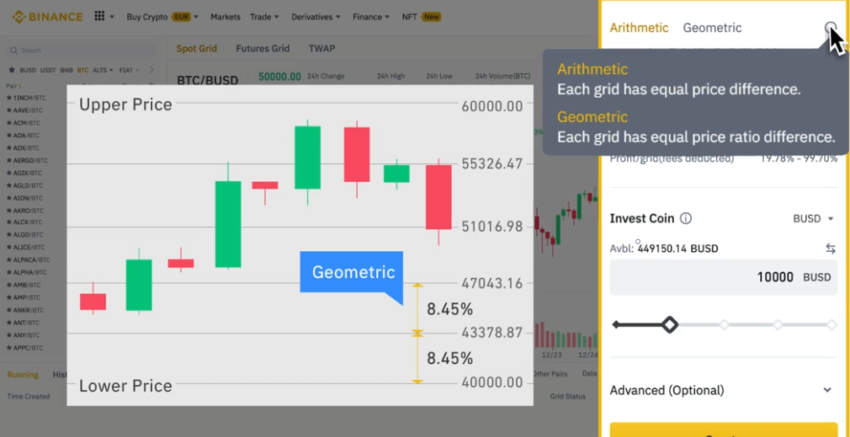

- Arithmetic or geometric mode. In the first case, the difference between the orders consists in a specific number, and in the second case – in the percentage.

- Profit per order. It must cover the trading commission, otherwise the system will warn about the risk.

- Cumulative investment.

- Type of grid and stop trigger activation, activation price. Affects the start and stop trading of the strategy.

- The upper and lower price of the stop loss.

- You can also enable or disable automatic cancellation of all running positions after the grid is stopped.

Activation and completion

Grid trading on Binance can be used to automate operations in certain cases – for example, you assume that the value of BTC will fluctuate between $30,000 and $40,000 over the next 24 hours. Then you can create a grid by setting the upper and lower limit at specified points, choosing the number of orders and the step between them.

Where to start:

- Go to “Trading” -> “Trading Strategies” -> “Spot Grid” tab.

- Sign the disclaimer (bottom right corner).

- Select a currency pair, set the above parameters (arithmetic/geometric mode, upper and lower price, grid frequency, etc.).

- Click Create.

Note that there must be sufficient funds in the spot wallet. In general, all of the rules (commissions, limits) that apply to normal manual trading also apply to grid trading.

All orders made in the process can be tracked on the “Running” tab at the bottom under the rate chart.

At any time, you can start “Complete” to end the work. The strategy will also stop itself in any of the following cases: the spot price has reached the stop trigger level; the trading pair is excluded from the listing; the maximum number of orders for a particular trading pair has been reached; the spot balance has run out.

Advantages and disadvantages

Conclusion

The grid trading strategy is one of the most popular and is often used by trading bots. By providing its clients with this integrated feature, Binance takes a part of this market and makes it easy for traders – with the proper knowledge, it’s done in a minute, no need to connect third-party programs, etc. The effectiveness of the strategy combined with the ability to control risks is a reason to try it in action. The technique performs well in highly volatile crypto markets and can help make good profits.