Every trader, novice or experienced, wants to make more profits from their activities. The desire to increase income, especially in difficult times of the pandemic, has attracted a large number of new participants to the crypto markets. The advantage of the crypto industry is that absolutely anyone has access to it, while stock markets have certain requirements.

But there are a lot of nuances in crypto-trading, which should be known and understood so that the process is not unprofitable. Maximum diligence and attention is required from the trader, and it is also important to choose the right platforms for transactions. Profinvestment.com editorial staff will tell you where it is better and more profitable to trade cryptocurrencies to make it convenient, safe and profitable.

Where you can trade cryptocurrency

Crypto exchanges

Exchanges are the most popular option for crypto trading platforms. But transactions always imply commissions – both for exchange and deposit/withdrawal. This is one of the important factors for choosing a trading platform, because large transaction volumes can lead to significant losses on commissions.

But the use of exchanges maximizes the choice of available operations for the management of digital assets. You can invest, use DeFi tools (e.g., take out a decentralized loan against the cryptocurrency instead of selling it).

Advantages and disadvantages:

p2p exchanges

P2P platforms are designed to allow users from any jurisdiction to find each other based on their desired terms of exchange – in particular, the method of payment. The platforms operate with an escrow mechanism that holds the seller’s cryptocurrency until the buyer pays for it. Payment is made outside of the exchange, directly to the counterparty’s details, which means there is no commission.

Advantages and disadvantages:

The exchangers

These services allow to exchange both cryptocurrency and fiat money conveniently and quickly. It is enough to choose the direction of the exchange, create and pay the application in the allotted time. However, due to the fact that market rates are constantly changing, one exchanger cannot always be the most profitable. Then it is wise to use monitors, such as BestChange, to determine the most optimal rate at the moment.

Advantages and disadvantages:

What exchanges are better to trade on

With minimal commissions

Examples of exchanges with the most loyal commissions (the maximum possible commissions are listed):

- Binance. Spot market – 0.1%, futures 0.02% / 0.04% (maker / staker).

- OKEx. Spot market – 0.08% / 0.1%, futures 0.02% / 0.04%.

- Huobi. Spot market – 0.2%, futures 0.02% / 0.05%.

- Currency.com. Spot market – 0.075%.

- Cex.io. Spot market – 0.16% / 0.25%.

- FTX. Spot market – 0.02% / 0.07%, futures 0.02% / 0.07%.

It is worth noting that fees can often be reduced – with the help of exchange tokens (such as BNB on Binance) or by increasing trading turnover. Exchanges always provide information about such opportunities in the commissions section.

Deposit fees are generally not available (if it is cryptocurrency and not fiat), while withdrawal fees depend on the specific currency and are calculated to cover the network fees charged by miners per transaction.

Without KYC

Exchanges that do not require KYC are now quite few. The authorities of different countries are trying to regulate cryptocurrency in one way or another, and one of the main conditions for this goal is to collect as much detailed information about users as possible.

Even if there is no mandatory verification, often the user still has to pass it, otherwise the functionality is severely reduced. If trading cryptocurrency anonymously is crucial for you, you can consider other ways.

CEX or DEX

All of the above exchanges belong to the category of centralized exchanges. This means that they are fully managed by a company, which has the appropriate license to operate. Centralized exchanges (CEX) are characterized by a convenient and intuitive interface. Their main disadvantage is that the user is forced to entrust the storage of his funds and transaction processing to a third-party service, which contradicts the decentralized nature of cryptocurrencies.

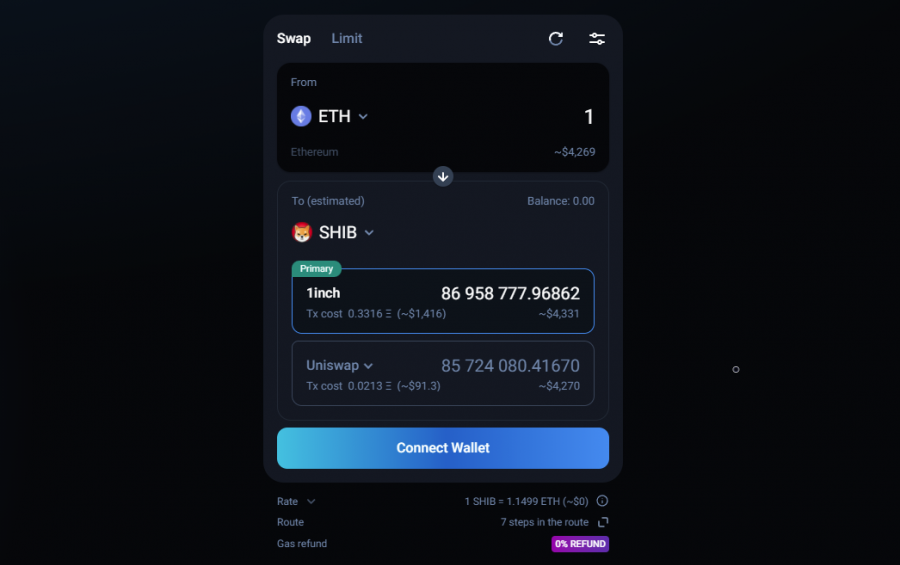

As for DEX – decentralized exchanges – although the site support and marketing lie with the company, but all transactions are made directly between traders’ wallets, the exchange does not manage them. To work with such sites requires a connection via web3 purse.

It is important to note that every transaction on DEX requires the payment of a network fee to the miners. If DEX runs on Ethereum, the commission can be very high. Therefore, this option is not suitable for small amount trading. But you can consider exchanges on other blockchains, such as BSC.

Conclusion

Now that you know the basic aspects of profitable cryptocurrency trading, it’s time to choose a reputable, trusted exchange that offers strong asset and identity protection, as well as an extensive range of trading destinations. Don’t forget to get a standalone cryptocurrency wallet, where coins will be stored when you’re not using them in trading. Storing on an exchange is risky because it can be hacked. For storing large sums, we recommend considering hardware wallets. Finally, start with small amounts, or better yet, a demo account that some exchanges offer so you don’t risk real assets.